why is actblue not tax deductible

If you have made contributions donations or payments for any of these that amount cant be deducted from your taxes. The same goes for campaign contributions.

![]()

Are My Donations Tax Deductible Actblue Support

Contributions or gifts to ActBlue are not deductible as charitable contributions for.

. ActBlue Charities is not responsible for any political content on this page. Access the Nonprofit Portal to submit data and download your rating toolkit. Paid for by ActBlue Civics.

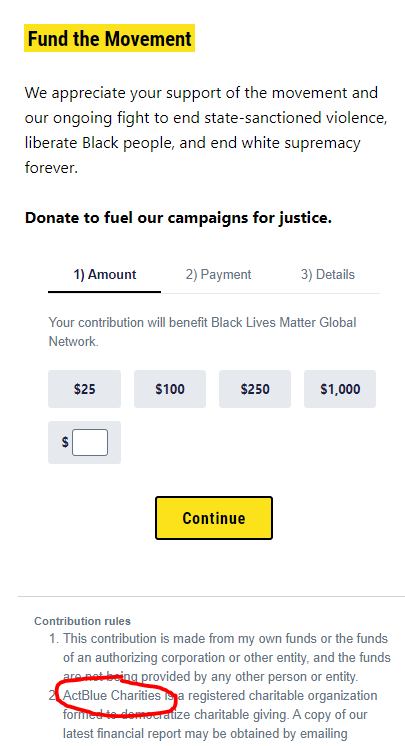

If ActBlue is non-profit and nearly ALL the money goes to entities and candidates with no financial benefit flowing to the donor why isnt a donation tax deductible. ActBlue Charities is not responsible for any political content on this page. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online or in person. Under federal law these contributions are made by individuals.

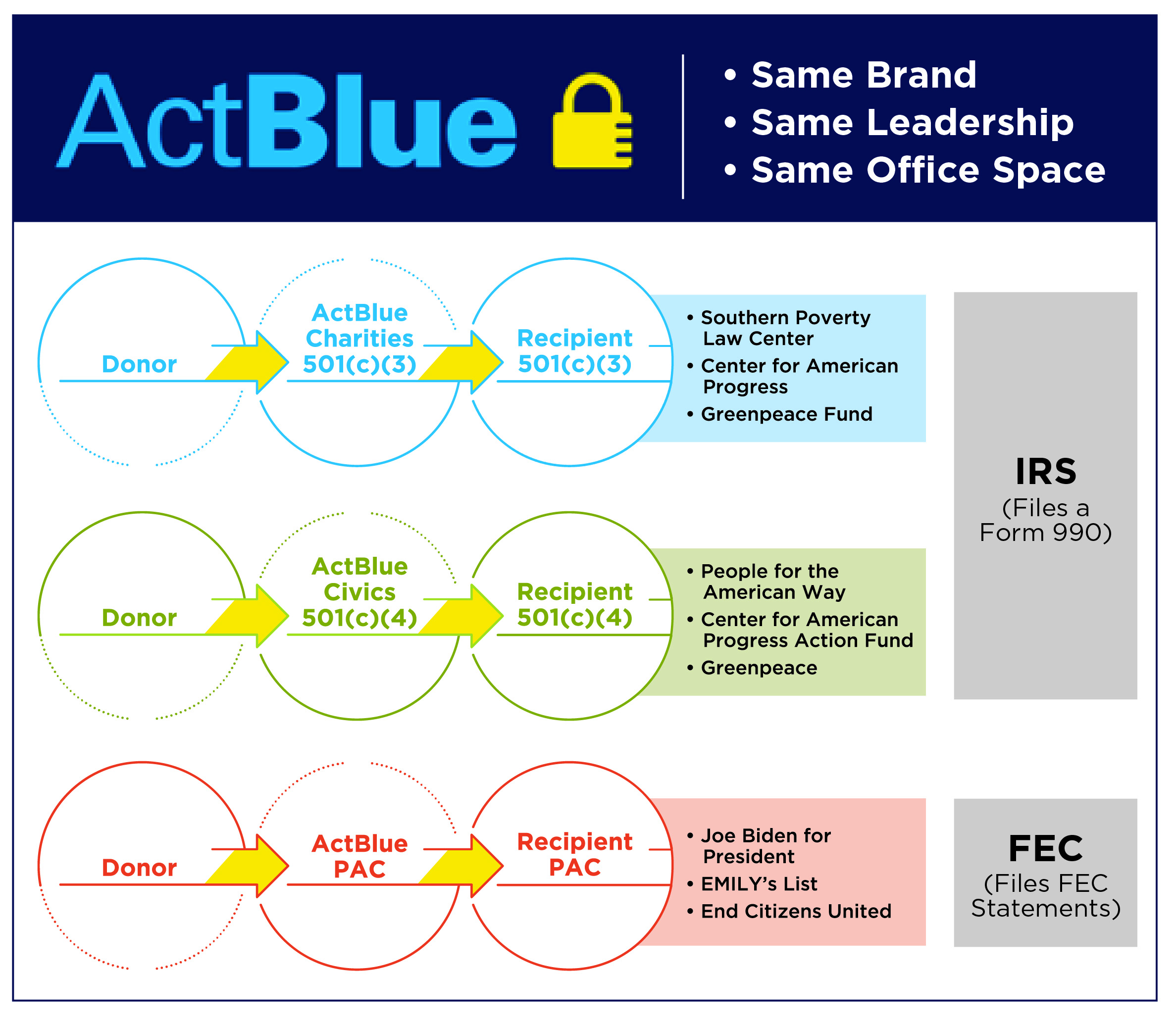

ActBlue is organized as a political action committee but we serve as a conduit for individual contributions made through our platform. The IRS Form 990 is an annual information return that most organizations claiming federal tax-exempt status must file yearly. ACTBLUE CIVICS INC is a 501c4 organization with an IRS ruling year of 2013 and donations may or may not be tax-deductible.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. Why is ActBlue considered a PAC. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

Tax Filings by Year. However donations to ActBlue Charities and other registered 501 c 3. Contributions or gifts to ActBlue are not deductible as charitable contributions for.

An individual can contribute as much as 36500 73000 per couple per calendar year to the DCCCs general fund for use at the DCCCs sole discretion. Contributions or gifts to ActBlue are not deductible as charitable contributions for. We do not fundraise or donate on behalf of anyone or choose candidates to support.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. Contributions or gifts to the DCCC are not tax deductible. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. Contributions or gifts made to other organizations through ActBlue Civics are likewise not deductible. Contributions or gifts to ActBlue are not deductible as charitable contributions for.

On second thought I didnt double check. Duplicated download links may be due to resubmissions or amendments to an organizations. ActBlue Charities is not responsible for any political content on this page.

The following list offers some examples of what the IRS says is not tax-deductible. Social welfare donations are. Charitable donations are tax-deductible for federal income tax purposes.

We provide the tools. Likewise gifts and contributions to 501 c 4 social welfare organizations are not deductible as charitable contributions. If this organization has filed an amended return it may not be reflected in the data below.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. By proceeding with this transaction you agree to ActBlues terms conditions.

By proceeding with this transaction you agree to ActBlues terms conditions. Unless informed by the DCCC of a different allocation the next 109500 of an individuals contribution will be for the DCCCs recount fund and all amounts in excess of this. They are not considered PAC donations.

Read the IRS instructions for 990 forms. ActBlue cannot be responsible for your treatment of these donations on your tax returns. Along the way the issue of ActBlue there was a link on TYTs site came up and I wanted to know why donations ARE NOT Tax deductible.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes.

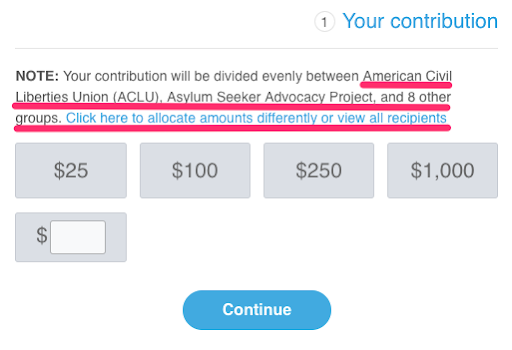

You may make unlimited donations to these groups on the site. Is this your nonprofit. ActBlue Charities is not responsible for any political content on this page.

I Don T Remember Adding A Tip To My Contribution Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

Actblue The Left S Favorite Dark Money Machine Capital Research Center

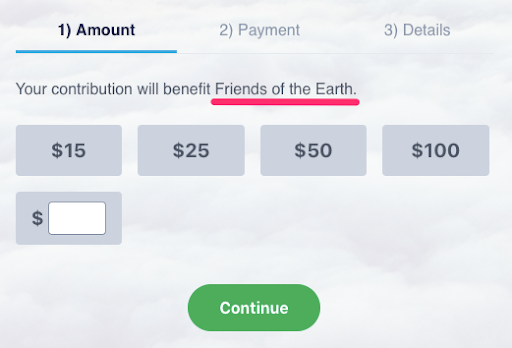

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

Actblue The Democrats 400 Million Dark Money Machine Capital Research Center

![]()

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

Actblue The Left S Favorite Dark Money Machine Capital Research Center

Are My Donations Tax Deductible Actblue Support